-3)

eBiznes

With eBiznes from Vodafone, your business will no longer need a traditional fiscal cash register! Now, with a very low monthly fee, you can declare sales and fiscalize tax invoices through the eBiznes application directly from your phone in real time to the General Directorate of Taxes, in accordance with Law no. 87/2019 dated 18.12.2019, “On the Invoice and the Circulation Monitoring System.”

Advantages of eBiznes from Vodafone:

Manage the list of products and services directly from the application

Monitor work remotely

Unlimited internet exclusively for the eBiznes App

Cancel invoices directly from the application

Apply discounts on products/services as needed

Send the client’s invoice electronically via email

Service termination without penalty

Billing with NIPT (Tax ID) or for individuals

Possibility to issue e-Invoices for cashless payments

Option to use from the web

Possibility to pay in installments for purchasing the device (Bluetooth printer)

Solution benefits

Follow the eBiznes tutorials on our YouTube channel by clicking HERE.

Security Packages for Businesses

Vodafone eBiznes

600 LEKË /month

Real-time invoice declaration, 12 months Data history storage

Package details

3,000/month

50/month

1

1

3

Vodafone eBiznes Premium

1,200 LEKË /month

Real-time invoice declaration, 12 months Data history storage

Package details

Unlimited

300/month

Unlimited

1

6

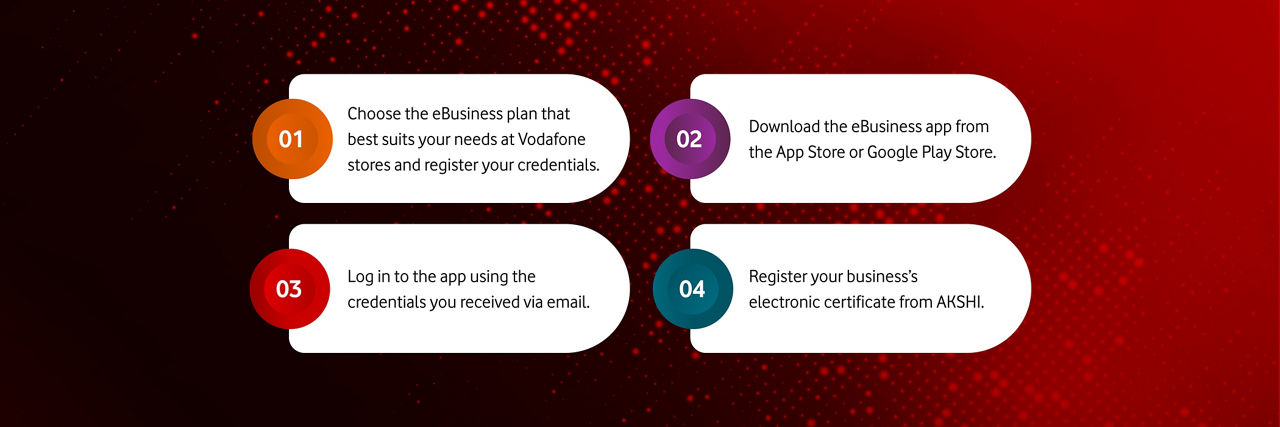

How to open an eBiznes account?

Helpful Videos

The innovative Vodafone eBusiness solution directly from the application

With Vodafone eBusiness, you have instant access to dedicated business services directly from the application.

Watch the video

How to make a sale

With Vodafone eBusiness, making a sale is simple and efficient. Just open the application, select the “Make a Sale” option, add the product or service you are selling, enter the price and the client’s basic details, if required.

Watch the video

How to register the electronic certificate and business code

The Innovative Vodafone eBusiness Solution directly from the application

Watch the video

Frequently Asked Questions

How does eBiznes work?

What do I need to register?

I already have a fiscal cash register, can I connect it to the eBiznes application?

With what device can I open the eBiznes application?

Additional questions for eBiznes

Additional questions for fiscalization